A inflação alta forçou o Fed a aumentar a taxa em 0,75%China's holdings of U.S. Treasuries skid to 12-year low; Japan also cuts holdings

https://finance.yahoo.com/news/fed-fomc ... 37242.html

Moderador: Conselho de Moderação

A inflação alta forçou o Fed a aumentar a taxa em 0,75%China's holdings of U.S. Treasuries skid to 12-year low; Japan also cuts holdings

Senators tack $45B onto Biden's defense budget

Lawmakers say high inflation and the need to arm Ukraine is adding to the cost.

This week’s boost brings the bill’s topline budget figure to $847 billion, according to Armed Services Chair Jack Reed (D-R.I.). The goal, he said, is to counteract runaway inflation, aid Ukraine, replenish weapons sent into the fight against Russia, and fund military priorities left out of the Pentagon budget request.

...

Biden sought $813 billion for national defense in his fiscal 2023 budget — including $773 billion for the Pentagon. Roughly $10 billion of the $813 billion falls outside of Armed Services’ jurisdiction.

But Republicans have been pushing for a substantial increase, arguing for a 3 to 5 percent increase from the current year’s level above inflation. The current year’s enacted level for the NDAA is $768 billion.

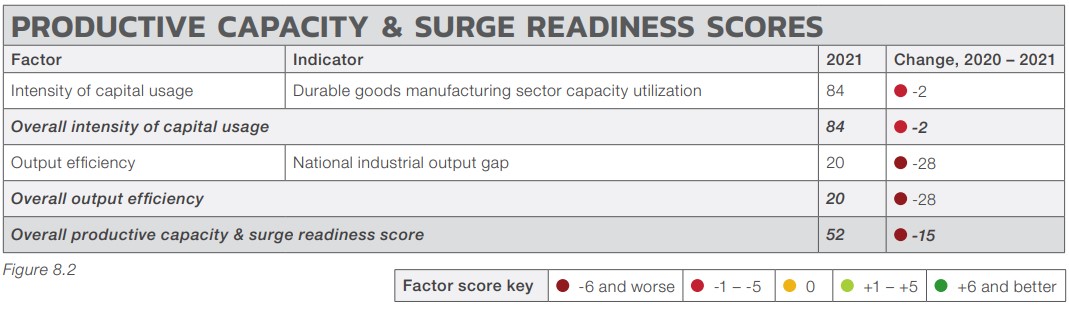

Alguns números para mostrar o declínio nas pontuações de prontidão.AREAS OF CONCERN

As a majority of the eight signs received failing grades for the first time this year, Vital Signs 2022 reveals a DIB that, similar to other industries, suffered sustained losses during the COVID-19 pandemic. Six of the indicators earned composite scores lower than 80 and five of these earned scores below 70, a grade considered failing. These scores point to a DIB struggling to meet the unprecedented and ongoing challenges created by the pandemic in the face of an increasing challenge from competitor nations.

“Industrial security” has gained renewed prominence due to data breaches and brazen acts of economic espionage, perpetrated by both state and non-state actors, that have plagued defense contractors. However, despite the importance of “industrial security”, this sign received a score of 50 in 2021, the lowest among the eight signs in 2022. To assess the “industrial security” sign, NDIA analyzed threat indicators to information security and intellectual property (IP) rights. The score incorporates the nonprofit MITRE Corp.’s annual average of the threat severity of new cyber vulnerabilities. This year, the analysis included the new National Institute of Standards and Technology’s 3.1 scoring system, superseding last year’s usage of the 2.7 system. Threats to IP rights scored well at 80 in 2021, as the number of FBI investigations into intellectual property violations declined to 38. This pattern marks a steady decline since investigations reached an all-time high of 235 in 2011.

Defense industry “production inputs” also scored poorly in 2021, receiving a failing score of 67. These inputs encompass skilled labor, intermediate goods and services, and raw materials used to manufacture or develop end-products and services for defense consumption. In particular, the indicators for security clearance processing contributed to the low score for “production inputs”, as on-boarding backlogs persist.

SUMMARY

The 2018 National Defense Strategy placed a heavy emphasis on investing in high-end technologies to improve overall capability. The question now is whether the 2022 NDS will do the same. Though we are still in a transitional period, indications are that the Biden administration will make relatively few changes in modernization priorities. DoD leaders have stated that integrated deterrence will play a large part in the new defense strategy, which will require technological improvement across all agencies and services100. The FY 2022 defense budget request also appears to stay the course

on future force modernization with record R&D investment in cutting edge technologies101. However, the DoD102 is still charged with maintaining current capacity while simultaneously improving U.S. deterrence capabilities — the modernization quandary.

Some uncertainty lies ahead for the future of emerging technologies, but if the U.S. wants to uphold its technological advantage in the great power competition, it needs to prioritize defense modernization above all else.

zela escreveu: Qua Jun 29, 2022 9:09 pm

Se o segundo trimestre ficar no buraco, que é o que tudo indica, será RECESSÃO.

Como já alertado aqui: https://defesabrasil.com/forum/viewtopi ... 7#p5609307zela escreveu: Qua Jun 29, 2022 9:09 pm

Se o segundo trimestre ficar no buraco, que é o que tudo indica, será RECESSÃO.

O novo discurso de propaganda é "A recessão dos EUA é TRANSITÓRIA"Any U.S. recession would likely be short, shallow, IMF official says

Além disso, eles apontaram que vão crescer mais que a China esse ano:Consumer sentiment falls to record low in June as inflation persists

Next China: US Could Finally Win GDP Growth Race

Esse discurso pronto veio em meio ao fato de que os EUA cresceu mais do que a China no Q4 de 2021, crescendo 5,5%, em comparação com os 4,0% da China. Foi a primeira vez em 20 anos que a economia dos EUA cresceu mais rápido do que a economia chinesa, isso deixou a turma do gagá meio histérico. Biden até afirmou que em 2021 sua economia cresceu mais do que todos os outros países como apontado em https://defesabrasil.com/forum/viewtopi ... 6#p5608826, o que é uma completa mentira, mais de 50 países cresceram mais do que os EUA em termos anualizados, incluindo a China que cresceu 8,1% isso quando o politburo do PCCh fixou uma taxa de crescimento de 6% em 2021, conseguiram um crescimento ainda melhor. Esse ano fixaram o crescimento em 5,5%.The world’s second-largest economy will grow just 2% this year, compared with 2.8% for the US, according to estimates from Bloomberg Economics. While China's economy is being constrained by President Xi Jinping’s unyielding Covid Zero policy, the US is being propelled by strong hiring and consumer spending even as it struggles with high inflation.

Rents nationwide 'increase at record-level rates'