March 11 (Bloomberg) -- Lockheed Martin Corp.’s F-35 jet fighter, its largest program, faces “substantial risk” of not delivering “the expected number of aircraft and required capabilities on time,” congressional auditors said today.

The program “continues to struggle with increased costs and slowed progress,” problems that “were foreseeable,” Michael Sullivan, the U.S. Government Accountability Office’s top F-35 analyst, told the Senate Armed Services Committee.

Sullivan, in prepared remarks, recommended the Pentagon consider reducing its annual planned purchases of the plane unless the program shows “progress in testing and manufacturing.”

Sullivan’s assessment is a warning to the world’s largest defense company. The Air Force wants to buy 43 fighters in fiscal 2011, 13 more than Congress approved this year. The armed services panel has authority to cut the request, and GAO recommendations often form the basis of congressional cuts.

The F-35 is the military’s most expensive weapons program. The projected cost for the planned purchase of 2,457 U.S. aircraft now appears to have increased to $323 billion from $298 billion two years ago, and that’s up 40 percent from the $231 billion when Bethesda, Maryland-based Lockheed won it in 2001, Sullivan said.

The Pentagon is taking “positive steps that if effectively implemented” should improve the program and provide “more realistic cost and schedule estimates,” he said. Still, “further cost growth and schedule extensions are likely.”

Next-Generation Fighter

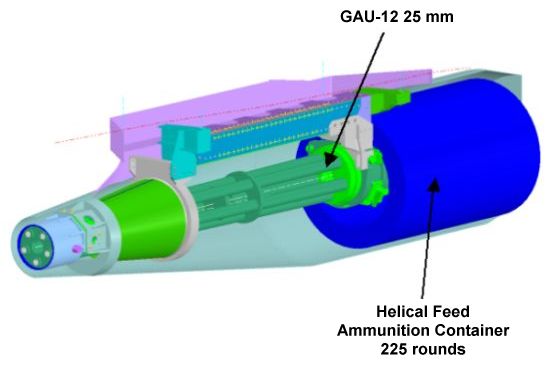

The F-35 is the military’s next-generation fighter. It is designed for missions including bombing and air-to-air combat, and it will be used by the Air Force, Navy and Marine Corps. It will replace aircraft including F-16s and A-10s, as well as Harrier aircraft flown by the Marines and the U.K.

Committee Chairman Carl Levin of Michigan said he convened today’s hearing because “we’ve been waiting for answers about costs -- where they have gone up and in what specific areas.”

“We’re concerned about both cost and delays and whether or not we are going to keep costs under control and what’s going to happen to the calendar: How is that going to slip, not just our for our own capabilities but what does that do to the allied participation?” Levin said in an interview before the hearing began.

The program has eight partner nations contributing their own funds for development, including the U.K., Italy, Canada, Australia, Denmark and The Netherlands.

Partner Nations

Sullivan told the committee that program costs overall have increased $46 billion since 2007, and the development schedule has been extended 30 months.

That extension includes a new 13-month delay directed last month by the Pentagon’s top weapons buyer, Ashton Carter. In addition, Carter added four test aircraft, shifted $2.8 billion in production funds for continued research and delayed the purchase of 122 jets to beyond 2015.

Carter, in remarks prepared for the committee today, said the Air Force and Navy now project they won’t have the first combat-ready planes until 2016, three years later than the Air Force planned and two years later than the Navy’s objective. The Marine Corps’ target date remains 2012, he said.

Air Force ‘Disappointed’

Air Force Secretary Michael Donley and Chief of Staff General Norton Schwartz said yesterday they “are disappointed” by Lockheed’s “failure to deliver flight test aircraft this year.”

The company has been experiencing “assembly inefficiencies that must be corrected to support higher production rates,” they told the House defense appropriations subcommittee.

Sullivan said that “by December, only four of 13 test aircraft had been delivered and total labor hours had increased more than 50 percent above earlier estimates.”

Lockheed Martin spokesman Chris Geisel said the company expects to be back on schedule next year and is making steady improvement in manufacturing.

“Production trends show radically marked improvement across the board,” including the latest three aircraft to enter the assembly line that are proceeding on schedule, he said in an e-mailed statement.

Lockheed fell $1.22 to $81.36 at 10:12 a.m. in New York Stock Exchange composite trading. The shares climbed 28 percent in the past 12 months.

http://www.businessweek.com/news/2010-0 ... -says.html

.jpg)